Everything You Ever Wanted To Know About Marina Insurance

Marina insurance – not to be confused with “marine” insurance, which is something different – is a type of insurance that protects people who own marinas from damage, legal liabilities and loss.

But what exactly is marina insurance?

Who benefits?

And why is it so important?

Here we will discuss all these issues and more.

Below is everything you ever wanted to know about marina insurance.

The Basics: What Is Marina Insurance?

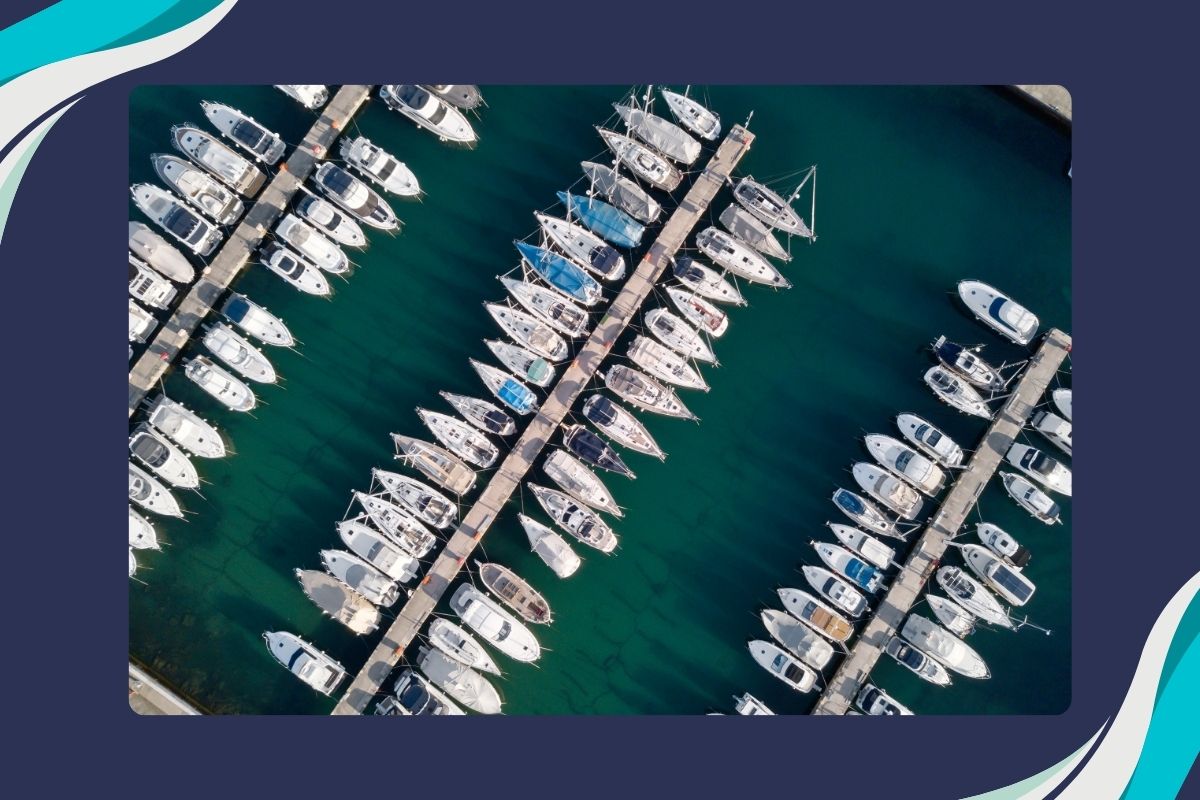

All around the world, there are thousands of marinas. Most coastal settlements have one.

It’s a place where private and commercial boat owners can moor their vessels before they head inland.

Marinas, however, aren’t entirely safe places.

They face all kinds of hazards, including theft, damage to boats, and sometimes, damage to the structure of the marina itself.

Marina operators can also face legal liability, so they purchase marina insurance.

Marina owners and managers want to ensure that when boat owners use their marinas to moor their vessels, they are protected against financial loss, which encourages the use of the marina by yacht and boat owners.

What Options Are There For Marina Insurance And Boatyard Coverage?

Marinas might appear to be tranquil places where boats bob gently on the water, but as any experienced boatyard manager will tell you, things can often go wrong.

An employee can become injured, a tidal surge can damage the structure of the marina, or the marina can face lawsuits from clients.

Marina insurance, therefore, comes with a range of options to suit your particular needs.

Most marina insurance products come with sudden and accidental pollution coverage.

This add-on protects against things like oil spills, sewage, or anything else that might make the marina no longer viable.

Marina insurance also protects against potential catastrophes that could befall marine employers.

For instance, the so-called “marine employers’ liability” protects the operator of the marina against legal proceedings claiming that the marina behaved negligently in some manner.

Marina insurance generally covers piers, wharves, and docks, although it is best to check with the insurance provider and not assume anything.

Other parts of the marina may be subject to additional fees.

Which Marina Insurance Product Should You Choose?

The marina insurance product that you choose depends heavily on the marina you operate.

Some marinas, for instance, cater heavily to the luxury yacht market and need insurance specific to their particular clientele.

Other marinas focus more on commercial operations, providing facilities for ships to enter and leave port, unload cargo, and so on.

Experts, therefore, recommend an individualized approach.

A traditional commercial property policy for your marina will cover you for the same things that other businesses enterprises protect themselves again.

This insurance protects against a loss of business income, damage from fire, vandalism, wind, explosions, and so on.

Additional types of insurance for marinas include:

Flooding Insurance

Here the insurance company pays out for any damage incurred by flooding in parts of the marina that need to remain dry.

Commercial Auto Coverage

Marinas often depend on commercial vehicles, such as trucks, to move boats from land to sea, and along the dockside.

Commercial auto coverage is special auto insurance that covers vehicles the marina uses to carry out its operations.

Hired Vessels And Barges Coverage

Marinas often need to hire boats and barges to conduct their operations.

Hired vessels and barges coverage is additional coverage that protects against loss and damage to these vehicles.

Owned Boats And Barges Coverage

Some marinas own their vessels.

Owned boats and barges insurance pays out for damage, loss, and theft related to these vessels.

Does Marina Insurance Cover Interruptions To Marina Activities?

Sometimes marinas have to close, often at a high cost to the owners.

Managers can no longer charge vessels for their use of the marina, cutting into revenues.

Managing this risk is essential.

Marina insurance sometimes protects against business interruptions as long as the sources of revenue are classified as “insured activities.”

So, for instance, if providing docking facilities is an insured activity of a marina, then the insurance company will pay out in proportion to any deterioration in gross profit.

Does Marina Insurance Cover Increased Costs Following Damage To Property?

Whether marina insurance covers increases in costs following physical loss or damage to property at the marina depends on the insurance policy.

Some policies provide this additional coverage, while others may only cover the cost of the damaged property itself.

Does Marina Insurance Protect Against Third Party Liability?

While the marina itself might operate under the law, the same might not be true of third-parties who use the facilities.

Many marina insurance products, therefore, protect against boat repairer’s liability, pollution liability, and products liability.

Does Marina Insurance Protect Against Wet And Dry Liabilities?

Marina insurance should ideally cover both wet and dry liabilities: that is the liabilities you face both on the water and land, and marinas operate on both.

When Should I Speak To A Marina Insurance Broker?

If you are considering marina insurance, then you should speak to a broker who specializes in that area immediately.

Understanding which type of coverage you need for your particular operation can be a challenge and depends on the circumstances of your marina operation. No two marinas are alike.