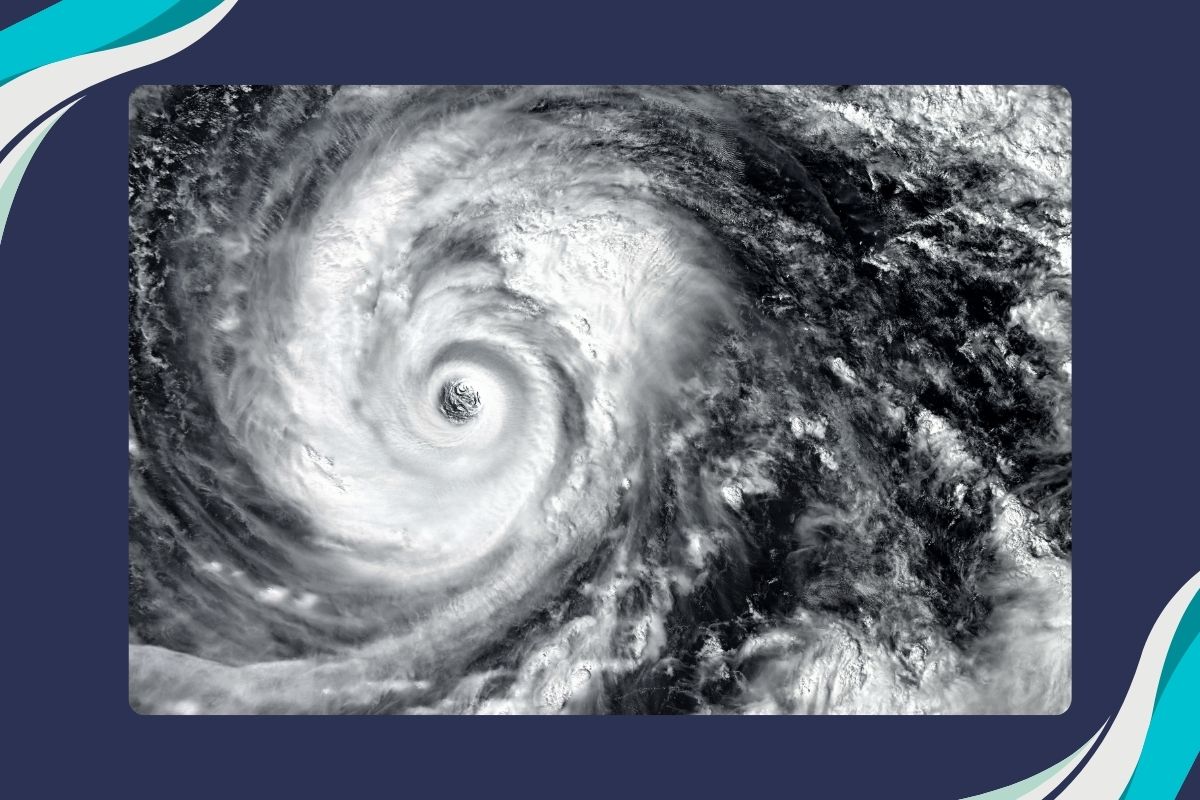

Investing in Hurricane Insurance in NJ

Hurricanes produce floods and strong winds, which can cause damage to houses. However, homeowners insurance does not necessarily cover the repairs. In reality, most homes that suffered flooding in 2020 were not in flood zones and were therefore uninsured.

According to FEMA, 30 percent of all flood damage claims occur in low- to moderate-risk areas where flood insurance is not needed or not consider to be important.

Homeowners and flood insurance are required in order to completely safeguard your property from storm damage. If you live in a hurricane-prone region, your home insurance may be required to include a windstorm rider. If not, then you’ll need to know as much about hurricane insurance in NJ as possible. Read on to find out more.

Make Sure You Have Adequate Coverage

Standard homeowners insurance protects the structure of your home against catastrophes such as hurricanes and windstorms, as well as a variety of other perils. It’s critical to understand the factors that could influence your insurance payment after a storm and to modify your policy appropriately.

Check your home’s insurance policy limit to ensure it would be sufficient to rebuild your house – the cost of rebuilding or substantially repairing a home is determined by a variety of factors – and keep in mind that a house’s real estate worth is not the same as the cost to rebuild.

As a result, it’s important to understand exactly how much it would cost to rebuild your home if it is badly damaged or destroyed and to ensure that your insurance will cover that amount.

It’s also important to understand your hurricane/windstorm deductible. Insurers might add separate deductibles for hurricanes and/or windstorms in their home’s policies, which are mentioned on the declarations page of your homeowner’s policy.

A hurricane deductible only applies to hurricanes, while a windstorm deductible applies to any kind of wind. If your insurance includes a storm deductible, it will specify the exact ‘trigger’ that will activate the deductible.

In contrast to the conventional ‘dollar deductible’ on homeowners insurance, a hurricane or windstorm deductible is often stated as a percentage, ranging from one to five percent of the insured value of your home’s structure.

If you live in a hurricane-prone region, your hurricane deductible may be a larger percentage, which is proportional to the risk the insurance company is taking on. Depending on your insurer and the state in which you live, you may be able to pay more premiums in return for a smaller deductible.

Therefore it’s important to know as much about your insurance options in New Jersey specifically, and why speaking to an expert is your best option.

Understand which catastrophes are covered by your insurance coverage and which are not – hurricanes, wind, theft, fire, explosion, lightning strikes, and other natural disasters are all covered by standard homes insurance plans. All plans, however, have exclusions, which are occurrences that are not covered by the policy.

Flooding is a frequent exclusion. People underestimate the danger of flooding, yet 90 percent of all natural disasters, particularly hurricanes, involve some kind of flooding. A separate flood insurance policy is required if you reside in a flood zone or in a hurricane-prone region.

Sewer blockages are another frequent exclusion (which is also not covered by flood insurance). In hurricane-prone regions, sewer backup insurance is often recommended, as this can be an issue after a storm.

Make Sure Your Possessions Are Adequately Insured

Consider the expense of replacing all of your furniture, clothes, and other personal belongings. Whether you have homeowners or renters’ insurance, make sure your coverage protects you against loss or damage caused by a hurricane.

A home inventory will help you determine the worth of your possessions. Making a complete inventory of everything you own and their values will allow you to easily determine if you are adequately covered for either replacement cost or the cash worth of the goods. It will also help to expedite insurance claims and give evidence of losses for tax or disaster relief reasons.

Look closely at your insurance to verify you have sufficient coverage. Homeowners’ plans typically cover 50 to 70 percent of the cost of insuring the construction of your house. If you rent, keep in mind that your landlord’s insurance only covers the structure of your house. You’ll need a renter’s policy to safeguard your belongings from loss or damage.

Make Sure Your Policy Provides Enough Coverage for Additional Living Expenses

Additional living expenses (ALE) cover the additional expenditures incurred if you have to relocate because your house has been made uninhabitable because of a hurricane (or any other insured disaster). While your house or apartment is being restored or rebuilt, ALE pays for hotel bills, restaurant meals, and other out-of-pocket costs that are not covered by your regular living expenses.

The ALE policy maximum is generally 20 percent of the amount of insurance coverage on your home’s structure. ALE is also covered by standard renters’ insurance.

Most insurers have greater coverage limits. Depending on where you live (which can influence your costs), you may want to choose a higher ALE. Speak to your insurer about the coverage limits in NJ, as this will help you make a decision.

ALE reimbursements can be restricted to a certain period. Check if the time limitations in your policy are acceptable to you. If you rent out a portion of your house, ALE coverage also compensates you for lost rental revenue. Check that your insurance covers the current amount of your rental income.

Hurricane insurance is vital to protect your home and belongings, so don’t put off getting it, especially since New Jersey is an area of the country that is prone to these specific types of storms. Speak to your insurance company for all the guidance and information you need so you can have complete peace of mind.